India's First Integrated Vacation Rental Platform

VRM Operations • PMS SaaS • Travel Marketplace

🏠

0

Properties Managed

📈

0%

YoY Revenue Growth

👥

0+

Guests Served

Hostsphere India Private Limited

Seeking: ₹1-1.5 Cr Pre-Seed Round

10-15% Equity • 24-Month Runway

The Problem

India's Vacation Rental Market is Fragmented & Underserved

For Property Owners

- • Complex multi-channel management across Airbnb, Booking.com, MMT

- • Manual operations leading to errors and double bookings

- • Existing PMS built for hotels, not vacation rentals

- • Average occupancy only 35-45% due to poor distribution

For Travelers

- • Discovery problem - authentic properties hard to find

- • Information asymmetry - photos don't match reality

- • Booking friction across multiple platforms

- • 91% of Airbnb India guests are domestic but lack local alternatives

Market Opportunity

0

₹ Crores

Market Size by 2034

0.2%

CAGR Growth

0%

Domestic Travelers

0x

Non-urban Growth

Our Solution

The Only Complete Vacation Rental Technology Stack in India

.jpg)

Hostizzy VRM

Full-service vacation rental management

- • 25 premium properties

- • ₹54L projected revenue (FY26)

- • 40% YoY growth

- • 13% commission rate

STATUS: Operating & Profitable

💻

HostOS PMS

Modern property management SaaS

- • Built for vacation rentals

- • Multi-property dashboard

- • Guest experience portal

- • Integrated messaging

STATUS: Production Ready

JuxTravel

Visual-first travel marketplace

- • Instagram-style discovery

- • AI-powered recommendations

- • Social trip planning

- • Direct bookings

STATUS: PRD Complete

🏆 Our Unique Advantage

We're the only company combining operations + technology. Our VRM business validates market needs and generates cash flow. Our tech products scale those solutions. Competitors are either operators OR tech companies - not both.

Product Showcase

Real Products, Real Traction

JuxTravel Mobile App

Juxtravel

Kerala Houseboat

What's included

Instagram-style discovery • Social travel planning • Direct bookings

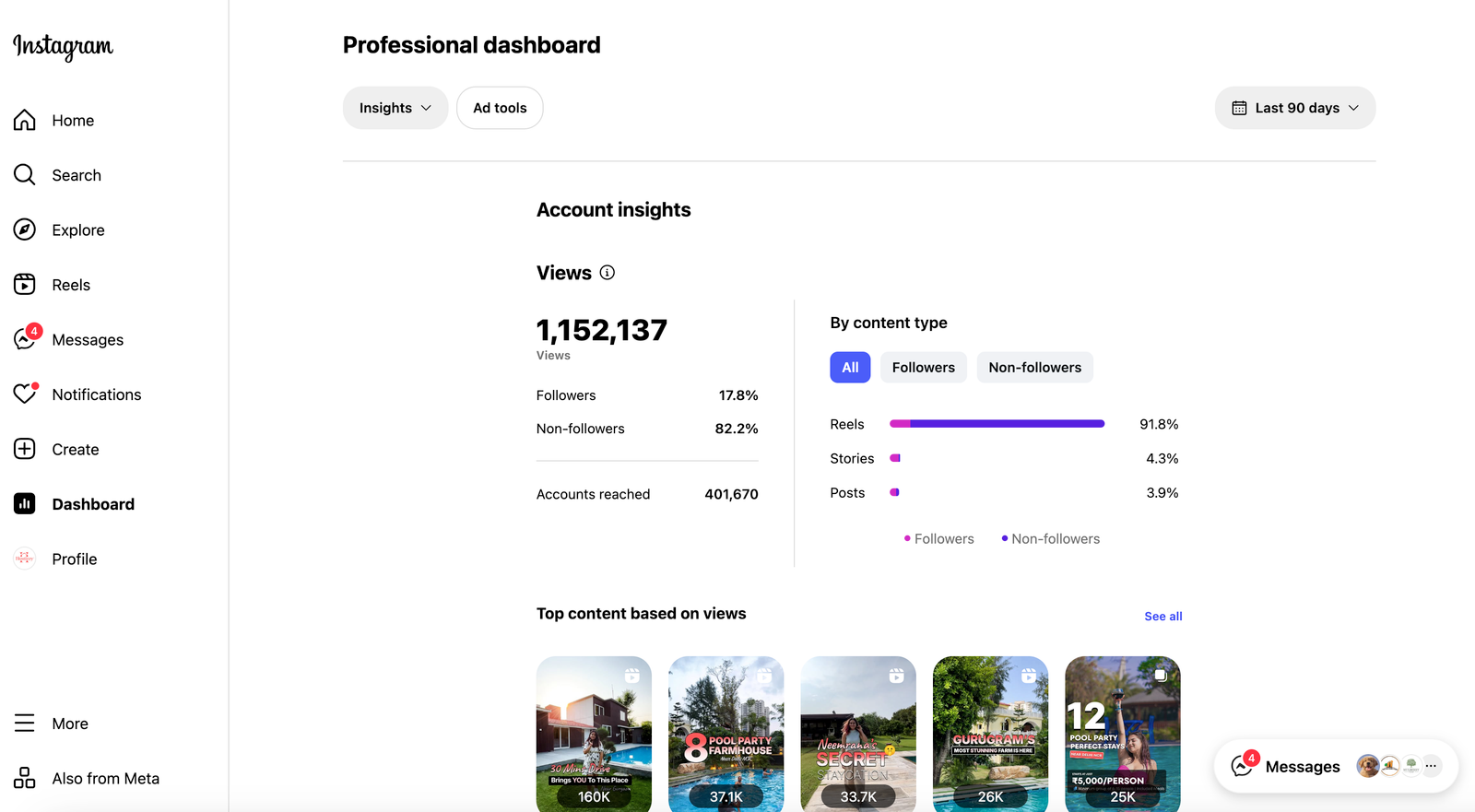

📊 Instagram Performance

Click to enlarge

0

Total Views

↑ 82% non-followers

0

Followers

0

Interactions

0.8%

Response Rate

HostOS Property Management System

Production-Ready SaaS: Multi-property dashboard • Automated messaging • Dynamic pricing • Channel management • Guest portal • Analytics

Proven Traction

Real Results from Property Owners

🎥 Property Owner Success Story

₹0L

Projected Revenue FY26

↑ 40% YoY

₹0Cr+

Lifetime GMV

0+

Guests Served

0.9

Average Rating

⭐⭐⭐⭐⭐

Business Model

Three Revenue Streams with Strong Unit Economics

Hostizzy VRM

🏠

Revenue Model

Commission: 13-18%

Current Status

₹0L ARR (projected)

Gross Margin

75-0%

HostOS SaaS

💻

Revenue Model

Subscription: ₹3,999/mo

Gross Margin

0-90%

LTV / CAC

0:1 (projected)

JuxTravel

🌍

Revenue Model

Commission: 12-15%

Gross Margin

0-95%

Take Rate

0% of GMV

Financial Projections

Path to ₹10 Crores Revenue in 3 Years

Revenue Growth Trajectory

| Metric | FY 25-26 | FY 26-27 | FY 27-28 | FY 28-29 |

|---|---|---|---|---|

| VRM Revenue | ₹63.3L | ₹85L | ₹1.5Cr | ₹2.5Cr |

| HostOS SaaS ARR | ₹10L | ₹48L | ₹1.2Cr | ₹3Cr |

| JuxTravel Revenue | - | ₹30L | ₹1.5Cr | ₹4.5Cr |

| Total Revenue | ₹73.3L | ₹1.63Cr | ₹4.2Cr | ₹10Cr |

Team & Advisors

Operators Building for Operators

Founder & Core Team

Led by hospitality veterans with deep operational experience in vacation rental management

3+ Years

VRM Operations

Deep Industry Expertise

3+ years managing premium vacation rentals across India. Extensive knowledge of property management, guest services, and operational excellence.

25 Properties

Currently Managed

Proven Track Record

Successfully managing 25 premium properties with 4.9 average rating. Served 30,000+ guests with exceptional service quality.

₹12 Cr+

GMV Processed

Financial Performance

₹12+ Crores in total GMV processed. Strong unit economics with 75-80% gross margins and consistent 40% YoY growth.

Investor FAQ

Common Questions About This Investment

India's vacation rental market is experiencing explosive growth with a 19.2% CAGR, driven by 91% domestic travelers and 3x growth in non-urban destinations. Post-COVID travel preferences favor private accommodations, and India lacks a comprehensive local platform combining operations and technology—creating a perfect market entry opportunity.

Unlike Airbnb (marketplace only), we offer the complete stack: (1) VRM operations managing properties end-to-end, (2) HostOS PMS SaaS for DIY hosts, and (3) JuxTravel marketplace. We're India-focused with deep local expertise, offering property owners full-service management while also empowering them with technology. Our operational experience validates product-market fit.

Key risks: (1) Competition from established players—mitigated by our unique ops+tech model; (2) Customer acquisition costs—mitigated by organic Instagram growth (49K followers); (3) Regulatory changes—mitigated by compliance-first approach and diversified revenue streams; (4) Technology execution—mitigated by proven HostOS in production with paying customers.

₹1-1.5 Cr will be allocated: 40% to product development (JuxTravel mobile app, HostOS enhancements), 30% to sales & marketing (property acquisition, user growth), 20% to team expansion (engineering, operations), and 10% to working capital. This provides 24-month runway to Series A metrics.

Series A targets (24 months): ₹4-5 Cr ARR, 100+ properties under management, 10,000+ monthly active users on JuxTravel, 100+ HostOS SaaS subscribers. At 4x ARR multiple, this values the company at ₹16-20 Cr, delivering 8-12x returns for pre-seed investors.

Multiple moats: (1) Operational expertise that can't be copied quickly, (2) Property owner relationships and exclusive inventory, (3) Technology platform with network effects, (4) Brand and trust built through Instagram (1.15M+ views), (5) Data advantage from managing real operations. Competitors are either pure tech or pure ops—not both.

Founder holds 85-90% equity post-funding and is full-time committed with no other ventures. Standard 4-year vesting with 1-year cliff. Clear cap table with no complex instruments. ESOP pool planned at 10-15% for key hires.

Key metrics: (1) VRM: Properties under management, occupancy rate (target 65%), ADR (Average Daily Rate), RevPAR; (2) HostOS: MRR, churn rate (<5%), LTV/CAC (5:1); (3) JuxTravel: MAU, booking conversion rate (3-5%), take rate (15%); (4) Overall: GMV, revenue growth, gross margin, burn rate.

Investment Proposition

Pre-Seed Round Details

Raising

₹1-1.5 Cr

Pre-Seed Round

Pre-Money Valuation

₹10-15 Cr

Equity Offered

0-15%

Target IRR

0-70%

Based on 3-year exit

Expected Exit Multiple

0-12x

Exit Timeline

0-5 years

Use of Funds

24-Month Roadmap

Path to Series A

Q1 2026

Funding ClosePre-Seed Fundraise & Foundation

- • Close ₹1-1.5 Cr pre-seed round

- • Launch JuxTravel MVP (mobile app)

- • Expand VRM to 40 properties

- • Onboard first 20 HostOS subscribers

Q2-Q3 2026

Growth PhaseProduct-Market Fit & Scale

- • Achieve 5,000+ MAU on JuxTravel

- • Scale to 60 properties (VRM)

- • Reach ₹1 Cr ARR milestone

- • Expand to 3 new cities

Q4 2026 - Q1 2027

AccelerationMarket Leadership

- • 10,000+ MAU on JuxTravel

- • 80+ properties under management

- • ₹2.5 Cr ARR achieved

- • 75+ HostOS paying customers

Q2 2027

Series A ReadySeries A Metrics Achieved

- • ✓ ₹4-5 Cr ARR

- • ✓ 100+ properties managed

- • ✓ 10,000+ monthly active users

- • ✓ Positive unit economics across all verticals

- • ✓ Launch Series A fundraise (₹15-20 Cr)

Get in Touch

Ready to invest in India's vacation rental future?

Schedule a meeting with our founding team to discuss this opportunity.

Send us a message

Hostsphere India Private Limited

₹1-1.5 Cr

Pre-Seed

10-15%

Equity

24 Mo

Runway

✓ Currently raising Pre-Seed round

✓ Looking for strategic investors

✓ Expected close: Q1 2026